Digital marketing to engineers works for several reasons. And you can’t argue against the results. I’ve been a big believer and a practitioner of digital marketing strategies and tactics for my industrial marketing and consultancy clients for several years now.

Let’s look at the big picture first – B2B sales. After all, engineering services and manufacturing companies are a subset of B2B companies. A survey conducted by management consulting firm Bain & Company found that 92% of B2B buyers prefer virtual sales interactions, up 17% from May 2020. The report notes that 79% of sellers also say virtual selling is effective, compared with 54% last year. (Source: Sales Content that Closes published by Allego).

Interestingly, Bain & Company has put together a webinar with the provocative title; Digital Marketing is Dead. Obviously, it is not dead, but digital marketing “as usual” won’t work either.

Digital marketing to engineers is effective

As I wrote in the opening paragraph, the results speak for themselves.

“Online information sources are the dominant ‘go-to’ for engineers researching a product or service for a business purchase.”

That finding is from the 2022 State of Marketing to Engineers report published by TREW Marketing and GlobalSpec.

69% of engineers go right to the source, the supplier’s, or the vendor’s website when researching a product or service. Research and information gathering happens in the early stages of their buying journey.

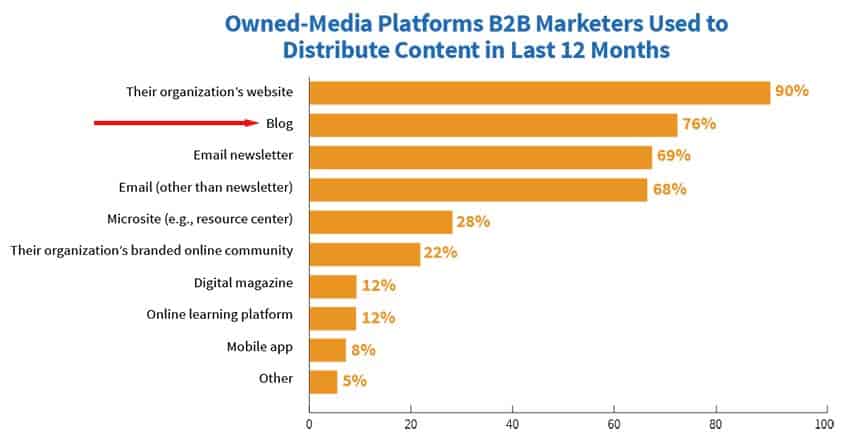

In short, an industrial website is the hub of your digital marketing strategy. It may be time for you to do a complete audit of your current website. It shouldn’t be limited to just technical issues for SEO. You should evaluate the following:

- Is the core messaging an accurate reflection of your company today?

- Do you have outdated information on products and services?

- What do you want site visitors to do after they find your site? Expecting them to call or email you after the first visit is unrealistic.

- Do you have clear calls to action for moving them logically through their buying journey?

- Have you taken steps to minimize the number of clicks required for visitors to find relevant information?

- Is the navigation intuitive and logical?

- Can you improve the user experience?

Honest answers to these questions will help you identify gaps in your website content and whether or not you should consider a complete industrial website redesign.

Content preferences of engineers

What sort of content do engineers use in making work-related decisions? When it comes to manufacturing content marketing, we often think of blog posts, white papers, e-books, etc.

Surprise, surprise – the good old datasheets are still #1! This is followed by downloadable CAD drawings. I’ve already written a few posts about the value of the second item as an effective sales enabler. (See my previous post).

Video plays a dominant role in engineering marketing

Looking at the above chart closely, you’ll see various forms of video mentioned. 96% of engineers consume videos for work-related purposes, with 53% watching one hour or more weekly.

Younger engineers, those 35 and under, tend to spend more time watching videos for work-related purposes.

Also, check out 4 Reasons Why Manufacturers Use Video Marketing, published by ThomasNet.

How to make content useful for your sales team

So far, I’ve talked about how engineers consume content in digital marketing. Now, let’s look at how the sales team can use content to become more productive. If you are an outside industrial marketing consultant like me or an in-house marketer, you know it is challenging to get Sales to use the content you produce.

I’m sure you’ve read this statistic before, but it is worth repeating. In 2013, Forrester reported that 60% to 70% of content produced by B2B marketing organizations goes unused. Even more startling was that many of their clients said that 80% of their content went unused. Needless to say, there’s a problem.

I’m not going to repeat all that’s been written about creating synergies between Sales and Marketing. However, I did find two key takeaways from Allego’s report for making content more beneficial for the sales team.

So there you have it—my take on why digital marketing to engineers is dominant today, backed by data from independent research studies.